This article aims to provide information on What Happens If I Don’t Transition My Vanguard Account? Skipping rollover on your Vanguard account brings some limits to your doorstep. Just think about it now trading, no updates of personal data. Rollover now to keep the account fully functional! Let’s dive in to know more.

What Happens If I Don’t Transition My Vanguard Account?

It is possible to lock your Vanguard account if you don’t roll it over. You cannot trade or proceed further until the rollover is completed. If you roll over your account to Vanguard, you will probably face some type of restriction on your accounts.

By that, it may inhibit trading, updating personal information, or even access to some services. You will be required to roll over to keep your account alive. It is pretty straightforward to carry out with the potential of avoiding many issues.

Can Vanguard Force Transition To Brokerage Platform?

No, Vanguard is not forcing a transition to a brokerage platform. To make managing your account easier, you can transfer your brokerage account to Vanguard. All accounts are being put onto one system; unless changed, your account might end up becoming limited.

Coach your customers to convert as soon as possible because if they fail to do so, they will not be in a position to trade or even utilize their accounts. Conversion comes with the guarantee that you will be able to access all of the services afterward. Vanguard views this change to get the experience of the users better.

Is Switching To A Vanguard Brokerage Account Absolutely Necessary?

No, switching to a Vanguard brokerage account is not necessary. If you switch, an account will activate in a Vanguard brokerage. Vanguard is retiring the legacy accounts and requires a change of account if you need to have this particular account active instead of losing trade functionalities and other services.

Vanguard brokerage accounts can be much less of a hassle and a more modern experience. Though the transfer appears to be some hassle, it will help you keep pace with your investments. This is one of those inevitabilities for a long-term consumer of Vanguard.

Do I Have To Convert Vanguard Mutual Fund To Brokerage Account?

Your Vanguard mutual fund account needs to be converted into a brokerage account as well. Vanguard’s consolidating that into a single platform for you, and otherwise you’re probably going to have much less access to your accounts.

This process aims at making your investment experience easier. Vanguard wanted all accounts to be under one system to avoid confusion and ensure better services. Conversion ensures that you keep your investments secure and accessible.

Vanguard Is Threatening Forced Transition Within 30 Days

Vanguard would send notice to claim transition in 30 days. In such a case, you would be restricted from making some changes to your account, but you will still have lost the right to share, for example, trading information or even updates, among others.

To save one from all such hassles, he needs to go through the process to the point and cover the whole procedure. Vanguard is trying to push all accounts onto its brokerage platform. No one should wait until the deadline arrives because, in a way of ignoring it, complications can crop up.

Vanguard Forced “Upgrade” To A Brokerage Account

Many investors at Vanguard feel that changing into brokerage accounts is somehow imposed on them. Even those satisfied with the system that existed before will be moved into the new one; one has to upgrade to continue making use of all the services this company offers.

Although this would sound like such an extreme change, Vanguard counters that it does make handling accounts easier. All investments are held in one place so things would be a little smoother. To avoid limits, clients would have to agree with this change.

Vanguard Forced Switch To Brokerage Account

Such a move has brought unease in some quarters since it makes clients shift to brokerage accounts. Some of the older clients loved their purely mutual fund-only accounts and had not seen any need for change. But Vanguard says it’s all in the cause of better services.

Vanguard is now going fully to brokerage and account conversion is not possible. Coercion ensures standard service for all its customers. The customers are risking some limited or an account-related problem by refusing to do so.

Switch To Vanguard Brokerage Account Or Pay Yearly Fees

Fees are directed to customers and are not rolled into the Vanguard brokerage account. Charges have been introduced by one company in a bid hoping that perhaps its customers will roll over. It is just one step toward the elimination of the more expensive old accounts.

All these unnecessary fees can be avoided by transferring while it is still open. It has more functionality and management features than the other one does. It only makes perfect sense to switch if you really do not want to pay all of these extra charges.

Vanguard Will Soon Charge A $100 Fee If You Transfer To Another Brokerage / Close Account

Vanguard said it will charge $100 to close accounts or for customers who leave for another brokerage. The cut is intended to keep them within its brokerage service. It deters the closing of accounts and transferring to other brokerages.

To avoid that accusation, it would be wise to move with Vanguard and try to find how possible a switch would be. Although there indeed appears to be a more significant pro of the new system as compared to its counterplay in the old one, this fee can be that mass center that would make some clients or investors prefer to hold back from a switch to another brokerage site.

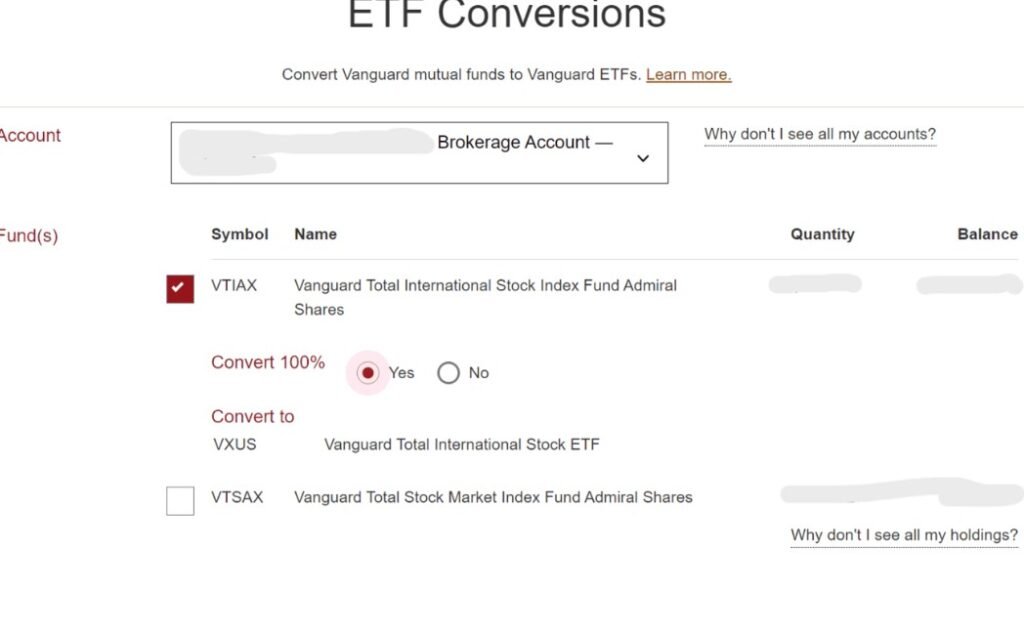

Difficulty Converting Vanguard Mutual Fund Accounts To Brokerage Accounts

Some of the Vanguard clients have experienced a minor hassle in trying to roll over mutual fund accounts into brokerage accounts. While the process is inevitable, it has overwhelmed some of the clients as they are subjected to a couple of extra steps in the changing process.

However, Vanguard does help facilitate the process in that regard to help ease things along. Guided with the right assistance, therefore, the entire process flows much better. First and foremost, the procedure is followed very closely so as not to delay or cause inconvenience to the account.

Anyone Else Regret Switching Vanguard Mutual Fund Only To Vanguard Brokerage?

Several clients have argued that after switching from the Vanguard mutual fund accounts to brokerage accounts, most complain of a change. They assert that their former platform is simple enough compared to the complexity of the new one. The transition process must have been quite demanding, and some may be facing some problems in the transition process.

While some people even miss the old version, others do benefit from their brokerage account. Added features and greater flexibility may outweigh the disadvantages as people become accustomed to it, but for many people, it still boils down to personal taste.

Date Set For Vanguard Retiring Its Legacy Brokerage Platform

The company would soon retire a legacy brokerage system that Vanguard had been using for years. This would all mean that all the client’s accounts had to be migrated into the new system or face account restrictions as all of the accounts would then be streamlined into the new brokerage platform by a certain deadline.

If you haven’t transferred yet, now is the time. Delayed transfer will result in only partial or limited access to your investments. Vanguard cares for its clients and assists them in transferring well in time before the final deadline.

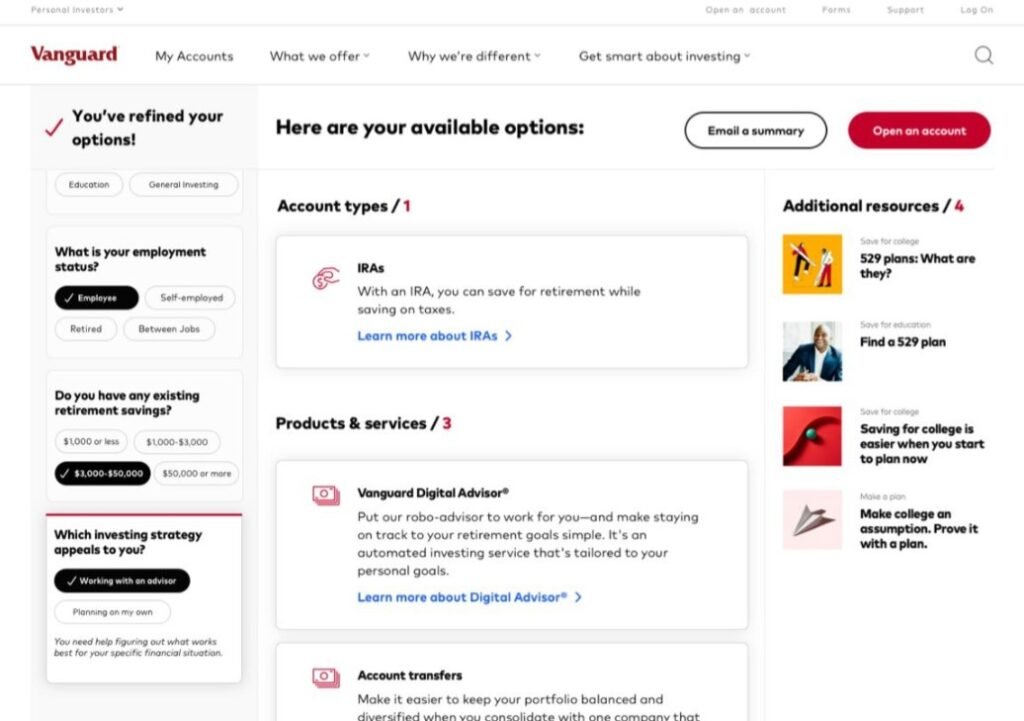

How Do I Transition From Vanguard Legacy Account To Brokerage Account?

It is fairly easy to transition a legacy account held with Vanguard into a brokerage account. Vanguard has tutorials that list what it takes to make this kind of change. Or you can call customer service for assistance or use the Internet.

Then you would be asked to transfer your investments to a brokerage account. It is a mandatory type of transfer, so be cautious when transferring. After transferring, you are supposed to gain access to Vanguard’s new platform.

Does Vanguard Charge To Close An Account?

In fact, you might pay a transfer fee if you want to close an account through Vanguard. The transfer fee, by the way, is applied at the time of a transfer to another brokerage. Vanguard’s new platform goes on to outline rules concerning account transfers and closing specifically.

You should talk about fees before you close your account with them so you will not be surprised by more fees. Vanguard refers you to a charge if there is any charge if it would charge once an account is closed. Knowing this will help you avoid some surprises.

Does Vanguard Close Empty Accounts?

Vanguard automatically closes some portion of your accounts in case nobody has used that account for a very long time. Perhaps an account you have never used but had zero balance comes up in their list of closes automatically. They usually close accounts without any money with no use. That forms part of the strategy they use to keep active accounts in their space.

An account needs to be funded or show any activity so that, if a person wants the account to stay open, one must have money in it or active activity. Its policy tries to cleanse the platform, shutting down inactive accounts. Ask about this with the customer service.

Conclusion

To conclude, the good news is that by rolling over, your account will not be locked. However, in rollover, you might not be able to trade and update your personal information. You need to roll over for all possible purposes to enable the update of your account.

Therefore, rolling over is the avoiding of service interruption; thus, continue enjoying available services. It is very easy to do so, and Vanguard has resources that are available to guide those who need to know how to do it. Upon rolling over, rest assured that your money is safe, sound, and there for you.

People Also Ask

Will I be locked out of my account if I don’t transfer?

In some cases, you will not be able to trade, and there may be a loss of access to information that updates your account.

Will Vanguard make it painless for me to transition?

Vanguard makes the transition as painless as possible.

Am I allowed to stay without transferring?

No, you will then risk losing some services, such as trading rights and updating your account information.

What happens if I miss the transition date?

Account restrictions or limitations are applied until the transfer is made.

Can I delay my transition until ad infinitum?

No, Vanguard encourages all accounts to transition or you will be cut off from full access.