Have you ever wondered about When Does SBTPG Update? Usually overnight, not too long after the IRS sends your refund. Though they can move fast, it depends on the IRS how fast they process it. If you are expecting a refund in cash, then you would want to know when that money is processed by SBTPG. Then there would be no shock. That means checking often, so you don’t miss anything.

When Does SBTPG Update?

SBTPG updates daily if the IRS is releasing refunds, otherwise it doesn’t. They update overnight sometimes about any tax transactions. Increases from SBTPG usually post overnight once the IRS has also processed refunds. You will be able to go to your account every day, and most likely find some updates already posted. It is all up to when the IRS is going to issue funds.

Who Is Santa Barbara Tax Products Group?

Santa Barbara Tax Products Group (SBTPG) helps taxpayers get refunds by offering tax preparation services. Coordinated effort with the tax preparers takes place in processing the transfer of refunds with SBTPG.

Direct pay of tax fees from refunds is one of the services offered by SBTPG. It provides a safe and hassle-free process of making tax payments right from within the minds of the people of the United States.

The company is situated in California and helps process millions of customers annually during the tax season. SBTPG makes refunds easier by efficient management of fees as well as payment. SBTPG strives to make tax refunds straightforward with tax experts by making their services reliable.

How Does The Refund Transfer Work?

There’s also an indirect payback in that refund transfers enable you to have tax preparation fees taken directly from your refund. As a preparer, SBTPG will forward the refund first to the IRS. That is helpful because it avoids up-front costs associated with filing taxes. That is a very good advantage for people who do not want to pay pricey fees.

It is an account-settling process that takes only six steps: it starts when the IRS accepts the refund. SBTPG ensures the fees are settled and transfers the rest to you very quickly. Many people love this refund transfer since it is usually less hassle and more convenient.

How Often Does SBTPG Update?

SBTPG upgrades its system daily, especially when it gets a refund from the IRS. These upgrades occur at night usually, so when morning comes, you will have new information. It keeps you well-informed of whatever has happened regarding your refund.

You will be sure of your refund status since it is simple to trace via the online portal provided by SBTPG. Every day you will receive updates as regards the movement of your refund. In case you are expecting a delivery of funds, you check your account daily. SBTPG works without a sound and reflects all changes or shifts.

Does SBTPG Update Daily?

Yes, SBTPG refreshes the system daily. So, you will have daily updates to make your account current and reflect new activity. It’s a seamless mechanism thought to best offer you the most current news about your refund. Keep checking the account if you are expecting to receive a refund.

SBTPG also updates daily. So, the customers always have information. The frequent updates make easy tracking of the refund. That means you receive updated information on when your refund is transferred to the bank. You are kept posted by a fast and reliable system.

What Times Does SBTPG Update?

SBTPG usually updates overnight. In case the IRS has sent information about refunds, they process overnight. Check your account first thing in the morning to know if updates have occurred yet. It ensures it does not delay and processes fast. One should check their account first thing in the morning for any new updates.

These updates can occur at any time through the night, contingent on when the IRS processes them. SBTPG strives to have the information ready for the following day. This way, you will be able to access the most updated information that you require without having to wait too long. Checking regularly will keep you on top of everything.

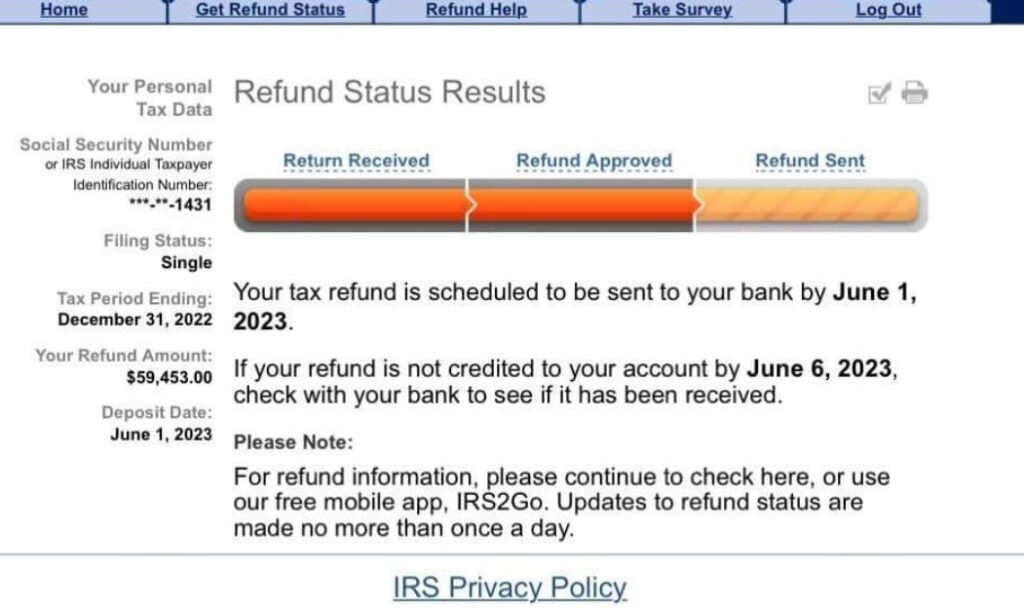

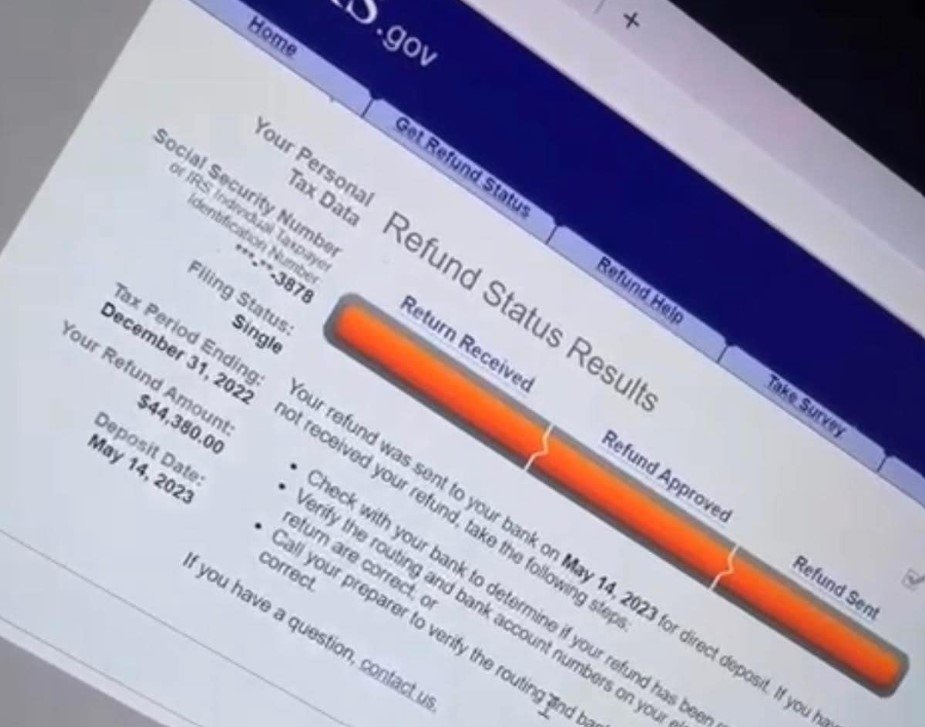

What’s The Status Of My SBTPG Refund?

Check your refund status on SBTPG’s website. They automatically update the status about whether the refund has reached, been processed, or has even been forwarded to the bank. This will clear any confusion that may have arisen. It also updates regularly, thus giving the information accordingly.

If it is late, you can also discover some reasons if there are any in the status. Tracking your refund status becomes easy and keeps you updated. Keep checking often to be informed.

When Does SBTPG Receive Your Refund?

The IRS will process the refund from SBTPG. A lot depends on when the IRS sends funds to SBTPG. You can monitor this online. As soon as SBTPG gets the refund back, they will make all efforts possible to directly transfer it into your bank account. Once you know when SBTPG is going to get the refund, then you will come to know once you are going to get the money.

How Long Does It Take To Get My Refund?

Generally, the processing time for the refund is the amount of time that the IRS takes from the day they issue the refund to SBTPG. Once your tax refund is approved by the IRS, it will then be it to SBTPG, whereby the money is directly transferred into your bank account.

Most clients acquire their refund within a week after IRS approval. SBTPG works to process its customers’ returns as soon and efficiently as possible. The account status is accessed quite frequently. Should there be a delay, then you will be kept abreast of the status of the SBTPG account.

How Long Before SBTPG To Release Funds?

SBTPG typically makes a disbursement one to two days after receiving the refund amount from the IRS. You’ll receive your refund pretty soon after the IRS makes it available. By monitoring your account day to day, you’ll be kept informed about when you can expect it to be released.

The time required to wait for your money is after the point at which SBTPG receives your refund. From there, the rest of the process is pretty fast when they receive it. Anyway, this will result in your getting your refund as soon as possible.

Common Reasons For SBTPG Refund Delays

Sometimes, it is delayed because of misinformation given to the bank or due to some issues with the IRS. If, after investigation, it is proved that you have provided the wrong information in the return, then the issue of getting the refund will take a certain amount of time.

Sometimes, the return needs to be processed by the IRS also, which takes some more time. Finally, if the data in the bank account does not tally with that of the tax return, the refund is held. All these can be averted if you crosscheck before your return is submitted.

Another reason SBTPG might delay is when the Internal Revenue Service holds some of your refunds for review. The basic reason for this usually occurs when the tax return has a chance of error or when it needs to be audited. Your account will let you know whether the taxes encountered some issues. Always double-check your tax return and bank account to avoid holding up most of the time.

Has SBTPG Funded Anyone Today?

SBTPG is expected to make deposit returns daily following receipt of funds from the IRS. More and more people would access their money every day through SBTPG. Logging of accounts may have determined whether the IRS had funded your refund.

The daily updating structures would have eased determining whether you had been funded or not. Things could be tracked easily by viewing accounts quite often. If you are expecting a refund, it is advisable to process through the SBTPG computer daily.

Upload is very prompt and will inform you if your refund has been transmitted. SBTPG works day in and day out just to ensure that people get their refunds as quickly as possible.

What Happens If My Tax Refund Direct Deposit Is Rejected By My Bank?

In case the bank rejects your direct deposit tax refund, SBTPG will deliver a check to you. The check is mailed to your address, which you used in filing the taxes. This process is more time-consuming than the direct deposit; however, it guarantees that you get your refund.

Ensure that your bank account information is correct in order not to appear on their list of mistakes. You may want to wait for a check in case it happens that the deposit is rejected 7-10 business days from the date you received the notice.

Other times, deposits are refused also via the bank account number and even routing information. Therefore, be sure to have your bank details ready so that the delay is avoided. When returned, SBTPG takes the trouble of sending the check back by post. Be sure to watch out for your post so you can access it safely.

What Happens If My Direct Deposit Is Returned?

The check will be mailed to your address; this was remitted for error or old data associated with your account and returned to SBTPG. You should ensure that the checking account information is accurate when filing to avoid such returns. A deposit is sent to the depositor, but it doesn’t delay your refund as you are assured of getting it.

Cross-check your account details so that your direct deposits do not get returned. When your bank sends back the payment, SBTPG defaults to mailing you a check. It’s in this way that you can get your refund, but it will be some days more. Monitor your account details.

How Long Will It Take To Receive A Check Mailed By Santa Barbara Tax Products Group?

If SBTPG sends the check by delivery, it takes 7-10 business days for you to get it in your mailbox. Mailing of checks is relatively a more time-consuming affair than direct deposits; so, please be a little patient and from SBTPG’s website track your refund status to get an idea regarding when you might receive that check.

The company will promptly take all measures so that all checks are mailed safely. Confirm the mailing address when filing, and you will not be delayed. In case you receive a check, wait for at least three working days since the mailing process is safe so will be your refund.

How Often Does SBTPG Update Their Return Transfer Website?

SBTPG updates your website daily, on the return transfer, so it is a great source of new data about refunds, transfers, and changes in account. You can log in and be checked on periodically to see if there have been any updates. It updates daily so you are aware of how your refund is going. It also helps to monitor your refund status very rapidly and easily.

As soon as SBTPG uploads new information from the IRS, the website updates automatically, so you can come back often to be informed of any new updates. This way, SBTPG keeps you constantly updated on information and never allows you to miss anything.

How Do I Contact Santa Barbara Tax Products Group (SBTPG)?

The SBTPG website or pages showing customer support may be what you need. They can also reach them easily by phone number or email. If you have questions about your refund, then SBTPG customer support will be more than happy to help you out.

If there is a problem with your refund or account, then the company may assist very much in solving the problem at hand. The way to get help is through contacting their customer service.

SBTPG has fast responsive customer service. Be it any issue regarding a refund or you just have one question about your account, their service is always on standby. Keep all this contact information handy, especially when that time of the year of taxes comes again. They also have useful resource materials and FAQs on the website.

Conclusion

To conclude, SBTPG is checked for changes done overnight once the IRS has processed refunds. Checked in the account daily are those changes that have been done. The final step is the tracking of accounts regularly and bringing you regular updates of changes. SBTPG processes refunds very fast and passes them to your bank. Checking daily helps you not miss important information regarding your return.

People Also Ask

How often should I check for updates?

You can always check your SBTPG every day to get information about any updates to your refund.

What time does SBTPG update?

SBTPG usually updates at night, and the changes available will be detected in the morning.

Will SBTPG update during the weekend?

Yes, SBTPG may update at weekends since the IRS may process refunds at weekends.

How do I know if my refund has been updated?

This can be achieved by logging into your SBTPG account online to ascertain the new update or change.