As you are in search of a reliable debt consolidation service, Debthunch might have attracted your attention. But Is Debthunch Legit? It is paramount at this time and era, with scams and organizations fooling people mercilessly, to be extremely careful while examining any debt relief service.

In this article, you will get to know every answer to your question concerning Debthunch, from legitimacy to services, customer reviews, and whatnot to help you get an understanding of whether this company can help you or not regarding debt consolidation.

Is Debthunch Legit?

Yes, Debthunch is a legitimate and authentic debt relief agency. Debthunch offers debt consolidation services to people suffering from unsecured credit card debts, with lower rates and less hassle in terms of repayment.

But just like any other company, it is always wise to read customers’ reviews before getting into it and putting your signature down to using their services.

What Is Debthunch?

Debthunch is a debt relief company that specializes in the consolidation of debts. The company assists individuals stuck under a mountain of high-interest debt, usually through such programs as consolidation loans or even the negotiation of lower interest rates.

It does this by putting together all debts, that an individual owes, and making one payment to that debt every month, with a possible reduction in interest rates, thus making it easier to get out of debt.

Debthunch can help someone with multiple high-interest debts from credit cards, personal loans, and medical bills. The company also has a 0 percent interest debt consolidation option, making it easier for someone to pay over time.

What Does Debthunch Do?

Debthunch is working with consumers to compile their debts into one single loan that is chargeable at a lower interest rate. They also work in other ways like negotiating with creditors, unsecured debt consolidation loans, or debt management plans to have lower interest rates based on the contract entered into.

Of course, the goal of Debt-hunch is to simplify their payments, reduce their financial stress, and make them debt-free more quickly.

Debthunch gives a customized solution to individuals depending on their financial circumstances. In addition to this, they also offer a 0% interest rate to qualified borrowers that can help ease their burden in debt management.

Is Debthunch A Scam Debt Relief Company?

Debthunch is not a scam debt relief company. It is a reputable company that has conducted debt consolidation services for many years. Like other financial services, one must do their due diligence.

A majority of the customers who have made use of Debthunch have shared positive experiences regarding the professionalism and effectiveness of the plans for getting out of debt. It is advisable to go through the customer reviews and perhaps contact a financial advisor to ensure that it’s the right choice for you.

Is Debthunch Accredited?

Yes, Debthunch has accreditations from the Better Business Bureau (BBB) and other financial regulatory bodies. The accreditation portrays it as a company committed to doing honest business and customer satisfaction.

When researching a debt relief company, one should confirm the proper accreditation as it usually indicates that the business upholds standards in the debt management industry.

Any Prior Experiences With Debthunch Or Credicare?

Consumers have a lot to say about how well they have been served by Debthunch. Other commenters refer to how effective the customer service has been compared to other similar debt consolidators, as well as how well this company offers its services by bringing those stubborn debts to lower interest payments.

Some users even straight away compared Debthunch with another debt-relief company, Credicare, and found Debthunch to be much more responsive and easier to work with for tailoring solutions to one’s finances.

How Does Debthunch Offer 0% Interest?

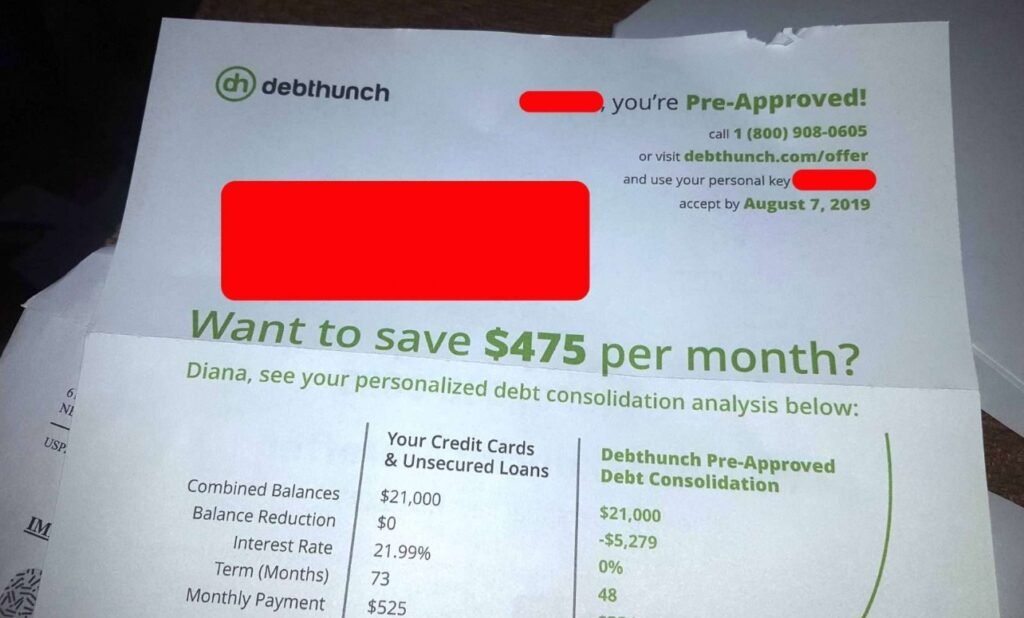

With Debthunch now offering qualified people a 0% interest debt consolidation loan, here is what the loan usually involves. The consolidation usually rolls several high-interest credit card debts into one loan while giving the borrower the reduced interest rate of 0% during a preset introductory period.

This usually jumps up after the introductory period but is generally good enough to give borrowers a chance to achieve timely repayment on debts without acquiring additional interest.

To be considered for a 0% interest debt consolidation loan with Debthunch, you usually require a good credit rating with plenty of stable earners and debt that is manageable generally for the service providers.

Thus, you need to know what terms and conditions come with these offers if the 0% helps in your long-term financial comfort rather than becomes a liability.

How Long Has Debthunch Been In Business?

Debthunch has had a considerable business time to prove well that they do recognize or shout out at least a very good reputation such as that among the citizens they serve or the other debt consolidation companies.

Though the year when it started is not widely spoken of, Debthunch has lent a good amount of reputation to itself within the industry for providing customized solutions to persons grappling with debt.

It also proves that the company has experience and expertise in this field, as it has an established history of working with debtors to provide effective debt relief options.

Why Debthunch Is The Best Debt Consolidation Company?

Several considerations mark Debthunch as one of the foremost possible contenders in the arena of debt consolidation.

- Zero Percent Interest: For those eligible for the offer, the company avails 0% interest rates and has proved effective in lowering the total cost of debts.

- Tailor-Made Debt Relief Plans: Personalized attention for every specific financial situation, with Debthunch assisting in evolving a realistic and achievable strategy.

- Customer Satisfaction: A very good number of positive reviews captures the customer service side of Debthunch and shows the role it plays in a customer’s journey to financial freedom.

- Accreditation: In a show of providing high-quality services, BBB-accredited Debthunch, the thresholds on accreditations, further prove the worth of their rating.

- Efficient Process: Their streamlined method makes the debt consolidation process quite efficient and less strenuous.

Has Anyone Tried Debthunch, Any Reviews?

Sure, a plethora of reviews exist concerning Debthunch from those who have personally experienced its services. The majority of them are positive, with some saying that it simplifies everything while its customer service is nice.

Consumers love what the company is trying to do for them regarding lowering debt such as by providing very low interest rates and making repayment easier.

However, as with many services, some of them also receive bad reviews. Some noted that initial approval processes or terms of consolidation loans were issues. Both positives and negatives need to be considered regarding an overall view of what working with Debthunch is like.

Who Is The Most Reputable Debt Consolidation Company?

Debthunch is one of the best companies dedicated to debt relief; other reputable companies in this line of work include National Debt Relief, Freedom Debt Relief, and New Era Debt Solutions. The best company for you would depend on your needs such as your amount of debt, your credit score, and the services you are looking for.

Are All Debt Relief Companies A Scam?

Not all debt relief companies are frauds. The industry is filled with those companies that have promissory and guarantees of debt reduction without delivering results, except for the big fees.

Therefore, one must do careful research on every debt relief company he/she is dealing with. By accreditation, by reviewing customer experiences, and also by knowing the terms and conditions before assigning themselves to that certain company.

Conclusion

To summarize, Is Debthunch Legit? Debthunch is a legit and good debt consolidation company, and this is the case because it provides personalized solutions such as 0% interest consolidation loans that may help people come back on their feet financially.

Even though it is important to consider all options and consult a financial advisor, Debthunch is a powerful choice for many people considering looking for reliable debt relief. Make sure that you carefully go through each program to find out if it meets your personal needs.

People Also Ask

Is Debthunch a legitimate company?

Yes, Debthunch is a legitimate company providing debt relief accredited by trustworthy organizations like the BBB.

How does Debthunch offer 0% interest loans?

Debthunch provides individuals with 0% interest loans by converting high-interest debt into one loan, which is under a promotional interest rate of 0% for a limited period.

Does Debthunch charge high fees?

In general, Debthunch does not charge excessive fees, but like any debt relief company, it is essential to review the terms before committing.

Can I get a 0% interest rate with bad credit?

It is much more difficult for people with bad credit to qualify for 0% interest loans, but Debthunch may still be able to help people with poor credit find options for debt consolidation.

Are all debt relief companies scams?

Not all debt relief companies are scams; it is, therefore, important to research well and choose a reputable firm such as Debthunch, which is accredited and has good user reviews.